There are great advantages to owning a home, yet many people continue to rent. The financial benefits are just some of the reasons why homeownership has been a part of the long-standing American dream. Let’s explore some other reasons, too.

Aside from the fact that you can live inside your own property, you are free to renovate, repair and landscape as you wish. There’s something quite liberating about being able to select your own paint colors and change your carpet as you wish. With a renters agreement, landlords maintain control and decision making when it comes to anything related to upgrades or repairs.

Another reason why owning may be a better option than renting is pets. Most landlords, if they allow animals, not only require a pet deposit or larger rent price but also limit the number and types of pets you can have. When you own your own, this decision is solely left up to you and your family (unless of course you move into a community with strict HOA guidelines. Check out our article about the Pro’s and Con’s of Having an HOA here).

Realtor.com reported that: “Buying remains the more attractive option in the long term – that remains the American dream, and it’s true in many markets where renting has become really the shortsighted option…as people get more savings in their pockets, buying becomes the better option.”

Why is owning a home financially better than renting? Here are the top 5 financial benefits of homeownership:

- Homeownership is a form of forced savings.

- Homeownership provides tax savings.

- Homeownership allows you to lock in your monthly housing cost.

- Buying a home is less expensive than renting.

- No other investment lets you live inside of it.

Studies have also shown that a homeowner’s net worth is 44x greater than that of a renter. A family that purchased a median-priced home at the start of 2019 would build more than $37,750 in family wealth over the next five years with projected price appreciation alone.

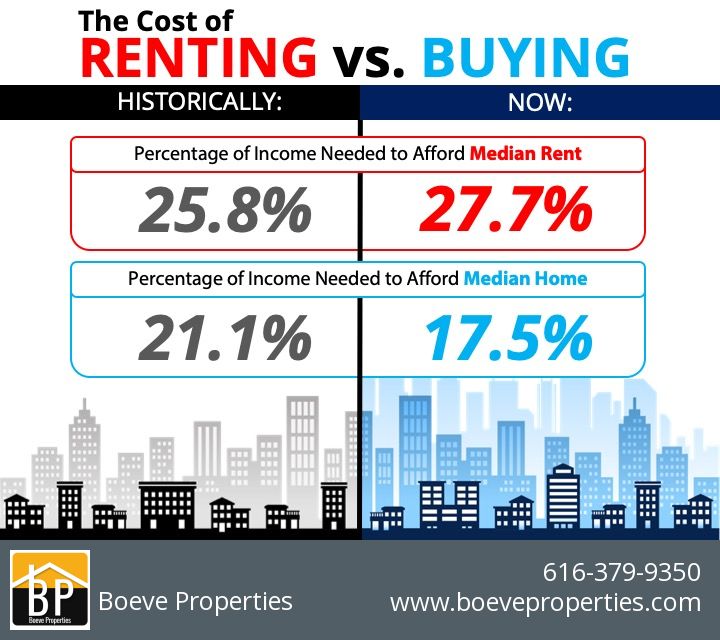

| Historically, the choice between renting and buying a home has been a tough decision. Looking at the percentage of income needed to rent a median-priced home today (27.7%) vs. the percentage needed to buy a median-priced home (17.5%), the choice is clear. Every market is different. Before you renew your lease, find out if you can put your housing costs to work by buying a home this year. Some may argue that renting eliminates the cost of taxes and home repairs, but every potential renter must realize that all the expenses the landlord incurs are already baked into the rent payment, along with a profit margin. |

For years, the rule of thumb stated renting is cheaper than buying so renting would free up money for other things, such as savings. That may not always be the case. A constantly shifting real estate market means it may be cheaper to buy than rent in certain areas. The right option for you is the one that best fits your goals and finances.

Bottom line, owning a home has many social and financial benefits that cannot be achieved by renting. Let’s connect to determine if buying a home is your best move.